This month, in advance of the next Conference of Parties meeting on climate change (COP28) which starts Thursday, the United Nations Environment Programme released its 2023 Emissions Gap Report, outlining still increasing global emissions and record breaking warming, and calling on all countries to take on rapid mitigation measures to lower and eliminate carbon emissions.

According to the report, this past September was the hottest recorded month ever, with global average temperatures 1.8°C above pre-industrial levels. And in the first nine months of 2023, there 86 days with temperatures over 1.5°C above pre-industrial levels.

The week before the stark report, the Angus Reid Institute released results of its latest survey showing how Canadians feel about one of the federal government’s key mitigation measures, the carbon tax. The economic tool has become a flashpoint for right-left politics in Canada and New Brunswick, and according to polling done by the Angus Reid Institute, 42% of Canadians would like to see the tax abolished. But, Angus Reid also found misconceptions about the tax were common.

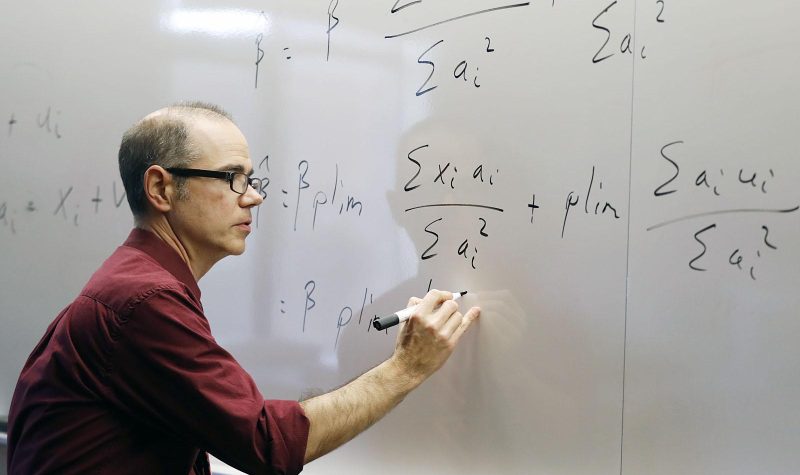

In light of the increasing debate and confusion, CHMA called up local economics professor Craig Brett to take us back to basics on the carbon tax. Brett gives us a lesson in how the carbon tax works, what it’s meant to achieve, and the role it does or doesn’t play in the affordability crisis.

Listen to the radio program with Craig Brett below: