Over the last couple of years, fraudulent scams of all types has become an issue of concern.

According to Jeff Horncastle, acting client and communications outreach officer for the Canadian Anti-Fraud Centre, investment fraud and romance fraud are at the top of the list in Canada with dollar losses almost doubling since 2020. The situation is similar in Quebec.

To avoid falling victim to scams, Horncastle highlights the red flags that should be looked out for and tips to remain secure.

“Looking at the dollar loss from 2020 to 2021, we saw a massive increase from $165 million in 2020 to a little under $380 million in 2021. It’s very obvious that the fraud is becoming more and more serious,” said Horncastle. “That’s largely due to the fact of the massive increase in investment scams, as well as romance scams and few other ones as well.”

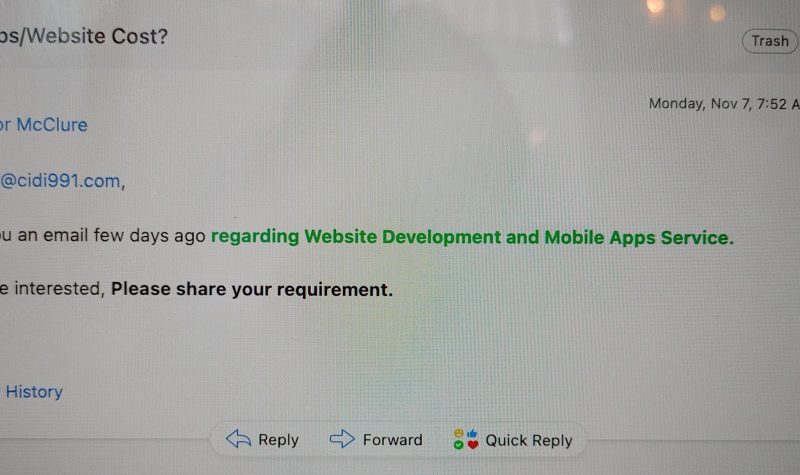

Horncastle noted that the use of technology by victims and scammers is a significant factor in scams, especially with the pandemic when people began to spend more time online.

“Naturally, when you’re spending more time online you’re more at risk. Same thing with the fraudsters. They have technology, spoofing is one of the main ones, so if we’re talking about telephone scams they can spoof phone numbers. They have the ability to make any phone number show up on your call display,” he explained.

In Quebec specifically, the situation is similar with romance and investments scams at the top of the list.

“When we’re looking at dollar loss, investment scams had a total loss of $13 million in 2021 and romance scams $4.5 million. We are seeing that two are closely linked together where a victim may start communicating with the fraudster on a dating site or social media, and then down the road they are convinced to invest into this fraudulent investment company,” explained Horncastle.

To avoid falling victim to these scams, Horncastle said that it’s important to do as much research as possible before providing any personal information.

“There as bunch of different red flags for all different sorts of scams, but the message that we like to get out there is take five. That refers to taking five minutes, or a week if you have to or a month, just to do a little bit of digging, do your due diligence, reach out to a friend. If you’re getting a weird email asking you to click on a link, reach out to the centre directly,” he noted.

CIDI also reached out to Quebec’s police force, the Sûreté du Québec (SQ), for some statistics on the Eastern Townships region.

According to Louis-Philippe Ruel, the agent information office for the SQ, when it comes to financial fraud in the region the statistics are as follows:

- 2019: 80

- 2020: 59

- 2021: 49

- 2022 (starting June 1st): 19

Statistics for identity theft fraud are as follows:

- 2019: 121

- 2020: 114

- 2021: 183

- 2022 (starting June 1st): 107

Ruel noted in an e-mail that “2021 and 2022 should be be comparable if the tangent continues.”

For information on the Canadian Anti-Fraud Centre and prevention tips.

Listen to the full interview below: